Being into the accounting industry is a lot to handle. Are you one of those? Accountants are incredible when they sort out business needs and queries and make it easy to manage those hard accounting norms. The idea of accounting is to enhance system efficiency with features that may be absent in regular working. While custom accounting software enables a smooth transition, which would appear to work perfectly for a particular case (since it is designed to support and address the specific needs of the organization involved), the use of a custom accounting software comes with numerous disadvantages.

To manage the working, we have Odoo V13 accounting software which is not just a modern and intuitive software but it is a great way to manage daily business. In this blog, we are going to discuss some of the important and influencing pointers to note for its performance and productivity.

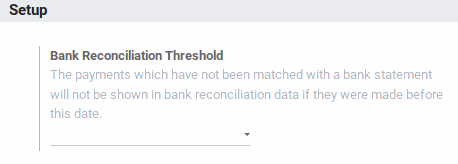

Bank Reconciliation Threshold added in Odoo V13

The payments which have not been matched with a bank statement will not be shown in bank reconciliation data if they were made before this date.

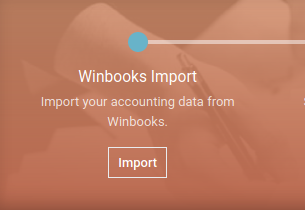

Winbooks data import added in configuration panel in an enterprise.

This is used to import data into Odoo 13 from winbooks. Its integration with importing the data from winbooks.

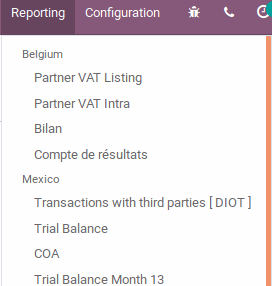

Belgium and Mexico reporting added in an enterprise

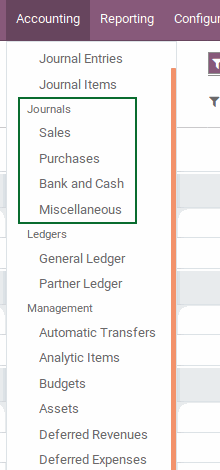

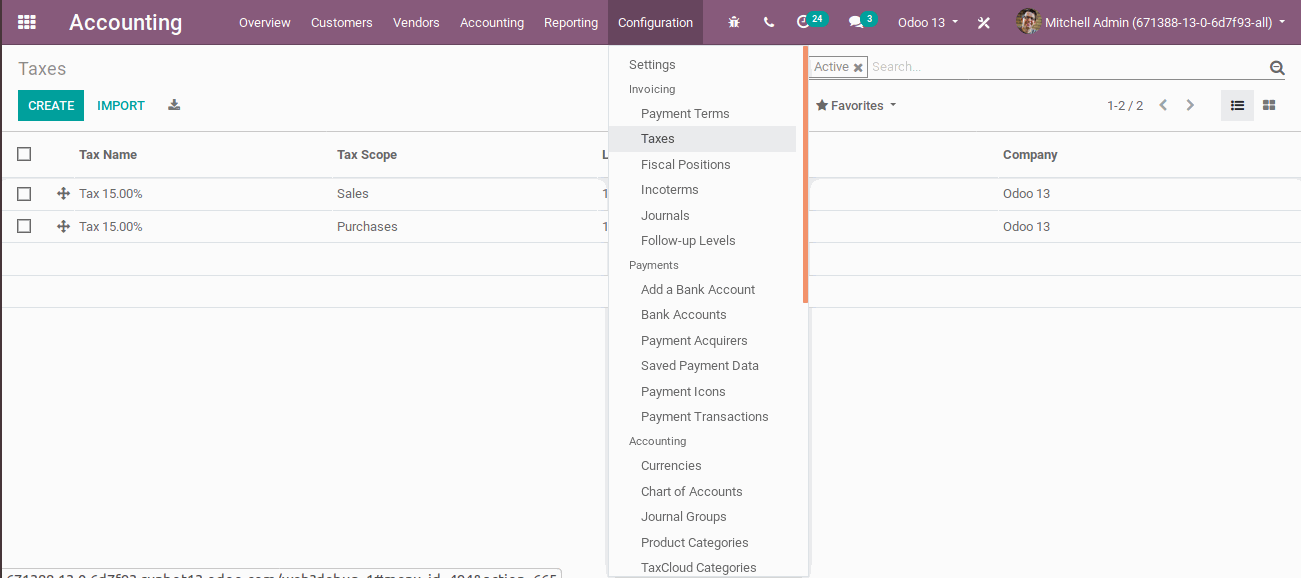

Journals are added in accounting menu and update it.

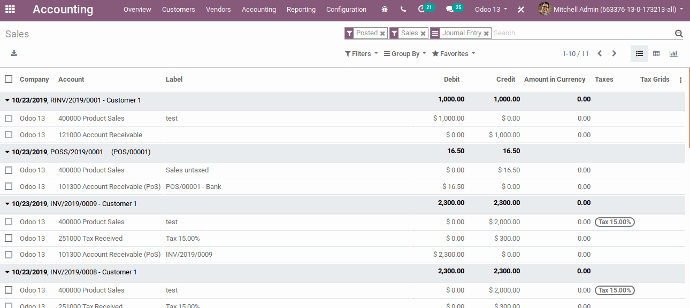

When we click on any Journal it will display entries in details

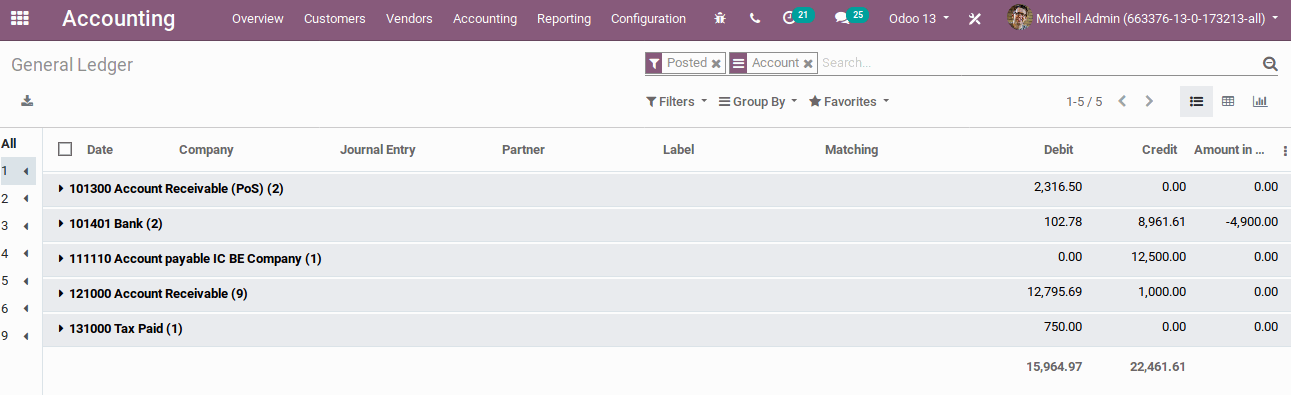

When we click on any Journal it will display entries in details Accounting ➤ Accounting ➤ Ledger ➤ General Ledger

Accounting ➤ Accounting ➤ Ledger ➤ General LedgerAccounting ➤ Accounting ➤ Ledger ➤ Partner Ledger

Accounting solution from better reconciliation, better usability everywhere, on journals and journal entries, but also new reports, consolidation, asset refactoring, more straightforward tax configuration, deferred expenses, and many more in Odoo 13.

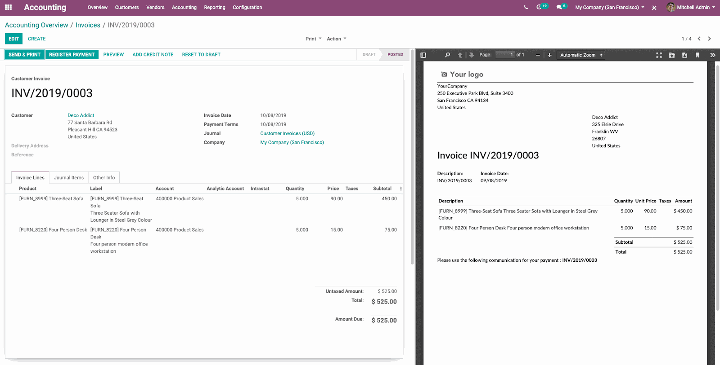

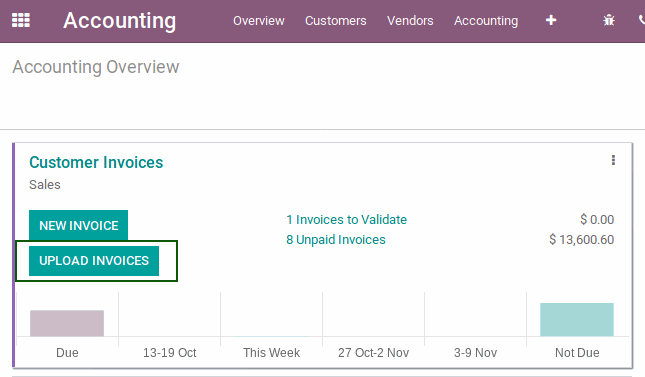

Upload mass customer invoices in Odoo 13 accounting

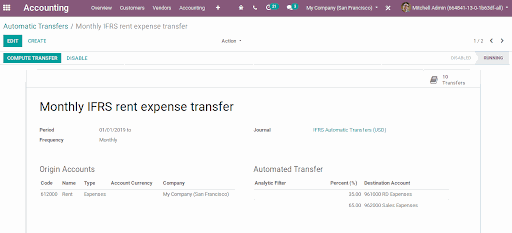

Automatic Transfer

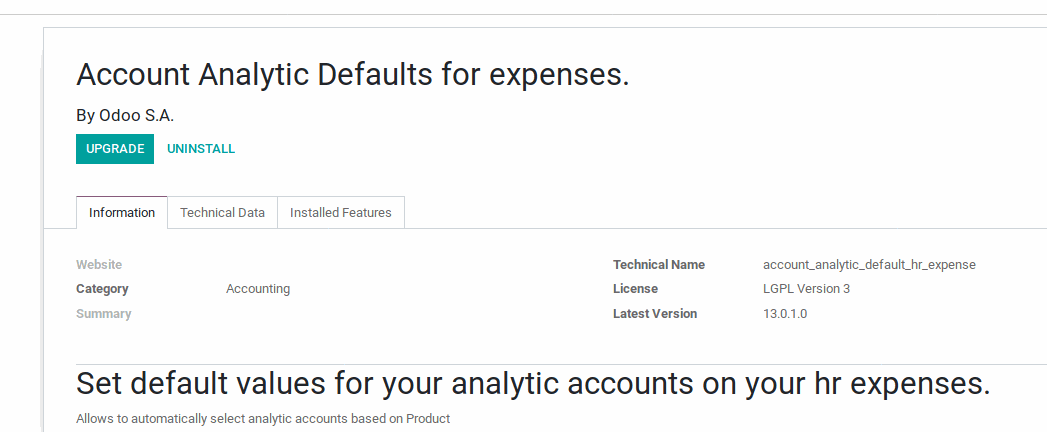

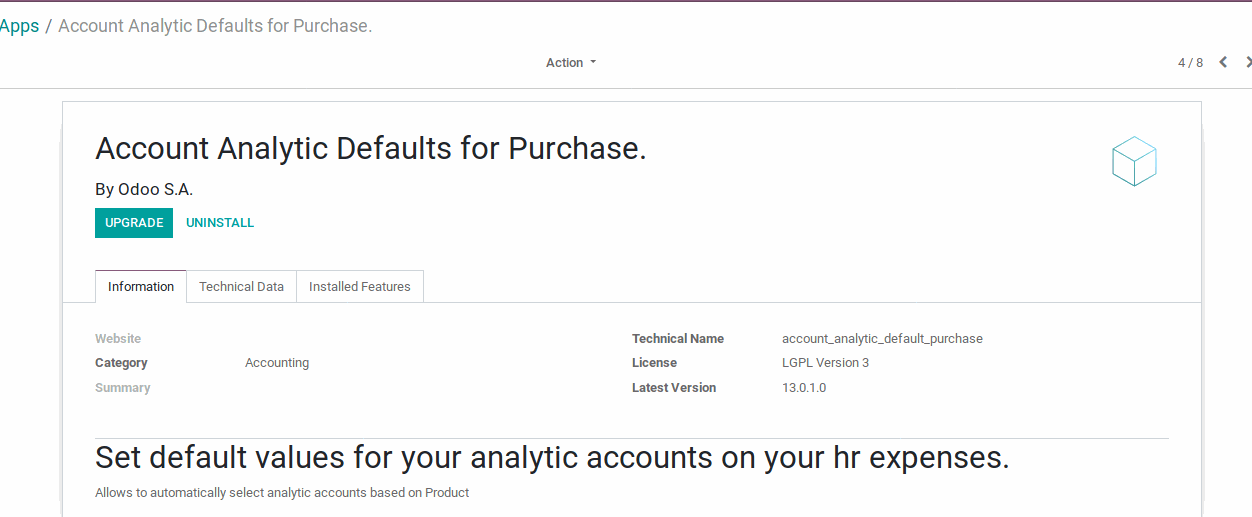

Modules

Account Analytic Defaults for expenses.

Account Analytic Defaults for Purchase

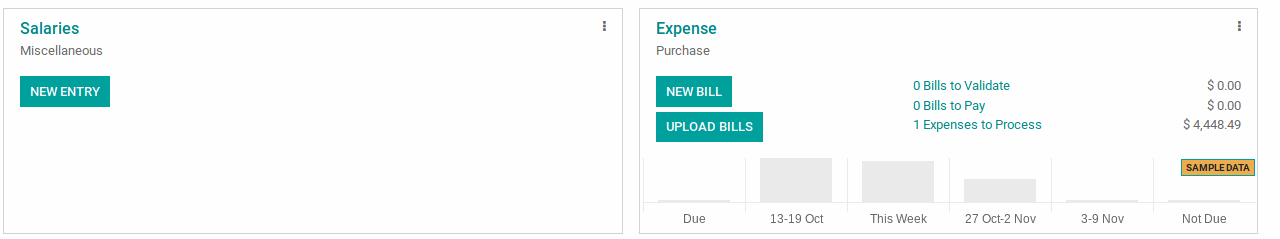

Salary and Expense Journal created and display on the dashboard.

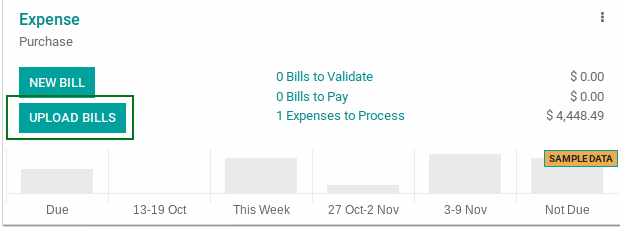

Upload Expense Bill also

Dynamic reports are available for all countries:

- Balance Sheet

- Profit and Loss

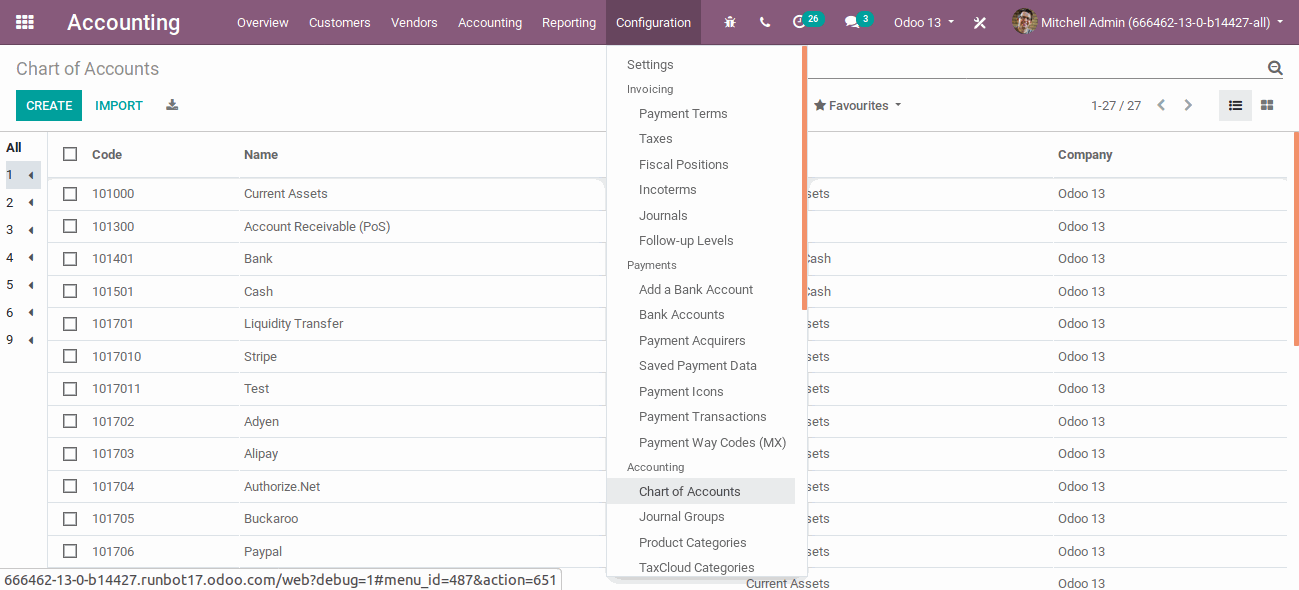

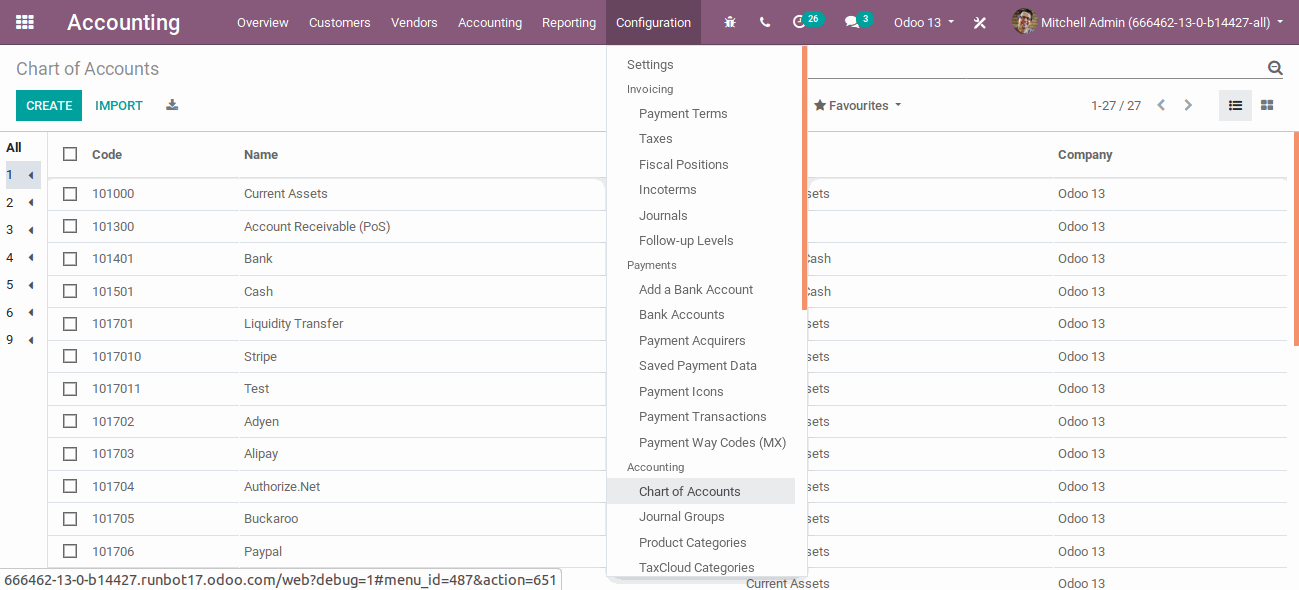

- Chart of Account

- Executive Summary

- General Ledger

- Aged Payable

- Aged Receivable

- Cash Flow Statement

- Tax Report

- Bank Reconciliation

Other Features

Tax changes in The Netherlands and Norway

- Recently, the governments of the Netherlands and Norway decided to increase their lower VAT from 6% to 9% and 10% to 12% respectively.

Easily retained earnings

- Retained earnings are the portion of income retained by your business. Odoo automatically calculates your current year earnings in real time so no year-end journal or rollover is required.

This is calculated by reporting the profit and loss balance to your balance sheet report automatically.

Import bank feeds automatically

Bank reconciliation is a process that matches your bank statement lines to your accounting transactions in the general ledger. Odoo ERP makes bank reconciliation easy by frequently importing bank statement lines from your bank directly into your Odoo account.

Calculate the tax you owe your tax authority

Odoo ERP totals all your accounting transactions for your tax period and uses these totals to calculate your tax obligation.

User can then check your sales tax by running Odoo's Tax Report.

Technical Changes

Model Merge

account.invoice ➤ account.move

account.invoice.line ➤ account.move.line

account.invoice.tax ➤ account.move.line

account.voucher ➤ account.move

Account.voucher.line ➤ account.move.line

Other Changes

- Technical improvements and QR code vendor bill payment allowed for SEPA regions.

- The models of customer invoicesSet default values for your analytic accounts on your HR expenses.

- Allows you to automatically select analytic accounts based on product, vendor bill and journal entry have been merged, allowing more flexibility in the edition of those documents.

- Prevent duplicate of partners based on VAT number.

- Import Belgian e-Invoices. Prevent account error on Balance Sheet and P&L Reports.

- Set default values for your analytic accounts on your HR expenses.

Chart of Accounts

Chart of accounts includes all the accounts, whether they are balance sheet accounts or P&L accounts. Every financial transaction (e.g. a payment, an invoice) impacts accounts by moving value from one account (credit) to another account (debit).

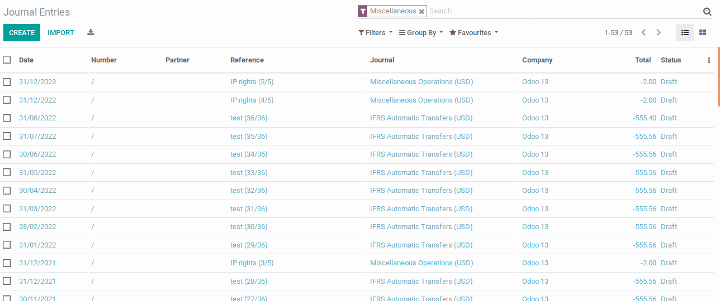

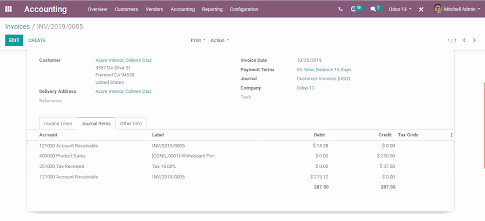

Journal Entries

Accounting ➤ Accounting ➤ Journal Entries

The financial documents of the company (e.g. an invoice, a bank statement, a payslip, a capital increase contract) is recorded as a journal entry, impacting several accounts.

Journal entry to be balanced, the sum of all its debits must be equal to the sum of all its credits.

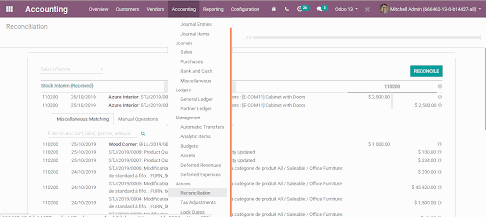

Reconciliation

The purpose is to link payments to their related invoices in order to mark invoices that are paid and clear the customer statement. This is done by doing a reconciliation on the Accounts Receivable account.

An invoice is marked as paid when its Accounts Receivable journal items are reconciled with the related payment journal items.

Reconciliation is performed automatically by the system when:

Payment is registered directly on the invoice.

The payments and the invoices links are detected at the bank matching process.

Bank Reconciliation

Bank reconciliation is the matching of bank statement entries with transactions recorded internally.

Previously recorded payment matching payment is registered when a check is received from a customer, then matched when checking the bank statement

New payment The payment’s journal entry is created and reconciled with the related invoice when processing the bank statement.

Another transaction recorded bank transfer, direct charge, etc.

Odoo should automatically reconcile most transactions, only a few of them should need manual review. When the bank reconciliation process is finished, the bank balance in Odoo should match the bank statement’s balance.

Accounting ➤ Accounting ➤ Reconciliation

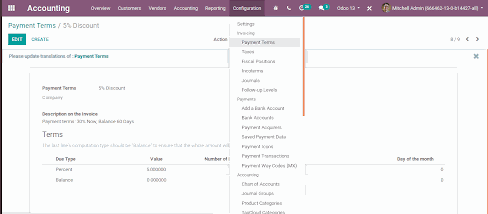

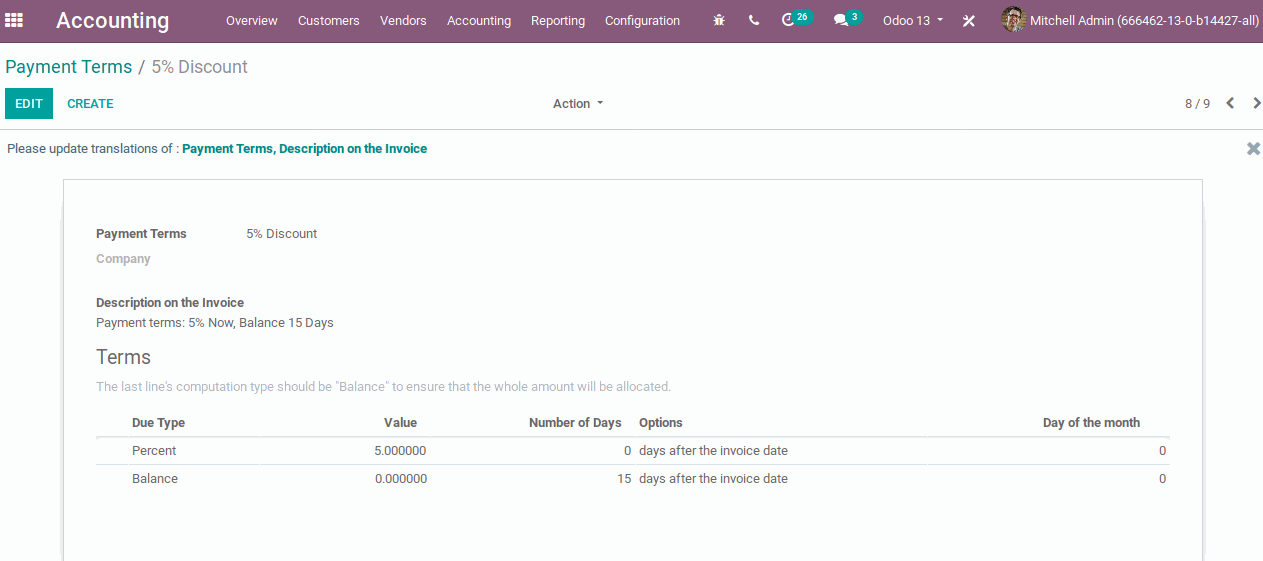

Cash Discount

Cash discounts are incentives you can offer to customers to motivate them to pay within a specific time frame. For instance, you offer a 5% discount if the customer pays you within the first 10 days of the invoice when it is due in 15 days.

Accounting ➤ Configuration ➤ Management ➤ Payment Terms

Journal Entry after post invoice

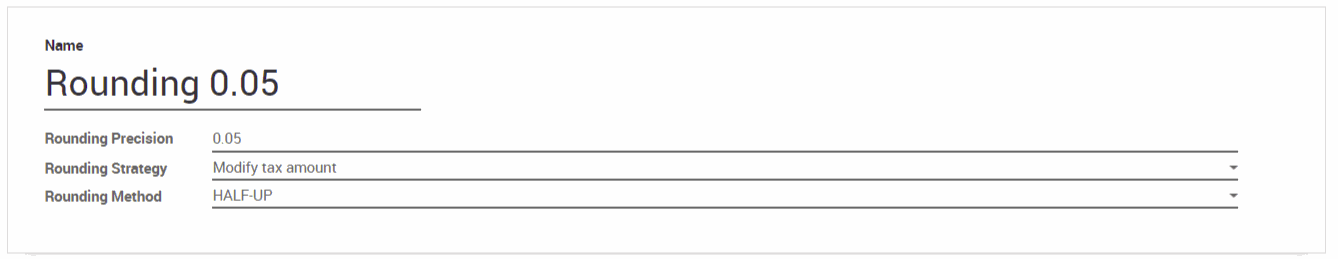

Cash Roundings in Odoo

Cash roundings mostly used In some currencies, the smallest coins do not exist. Users have to round their total amount to the smallest coin that exists in the currency. For the CHF, the smallest coin is 0.05 CHF.

There are two Rounding Strategy:

Add a line on the invoice for the rounding, Odoo will add a line on your customer invoice to take this rounding into account. You also have to define the account in which the rounding will go.

Modify Tax amount, Odoo will add the rounding to the amount of the highest tax.

Accounting ➤ Configuration ➤ Settings

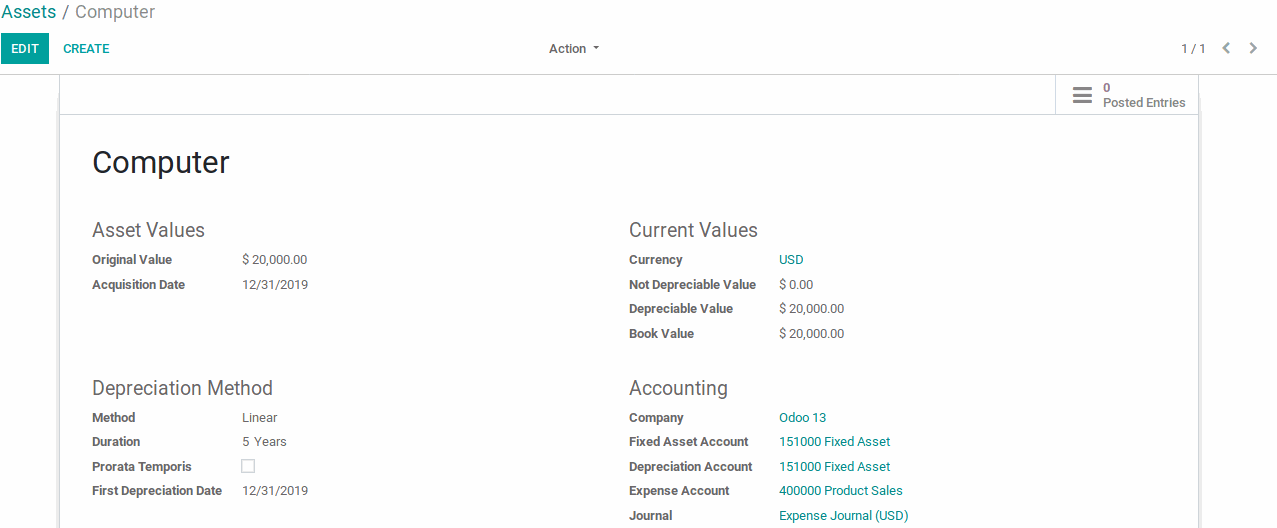

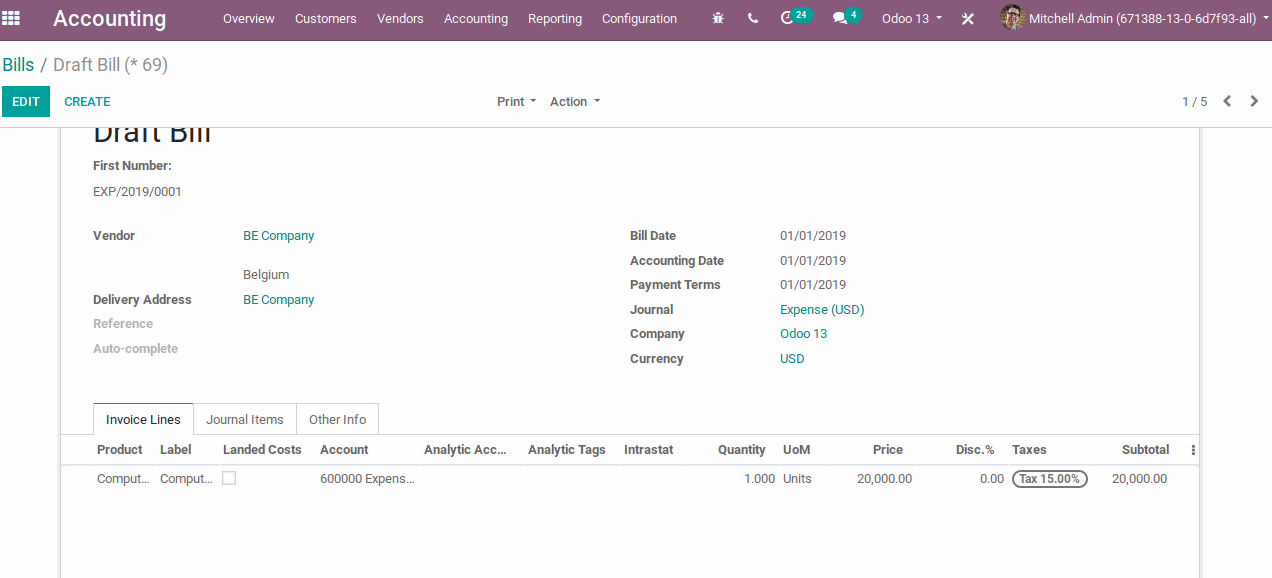

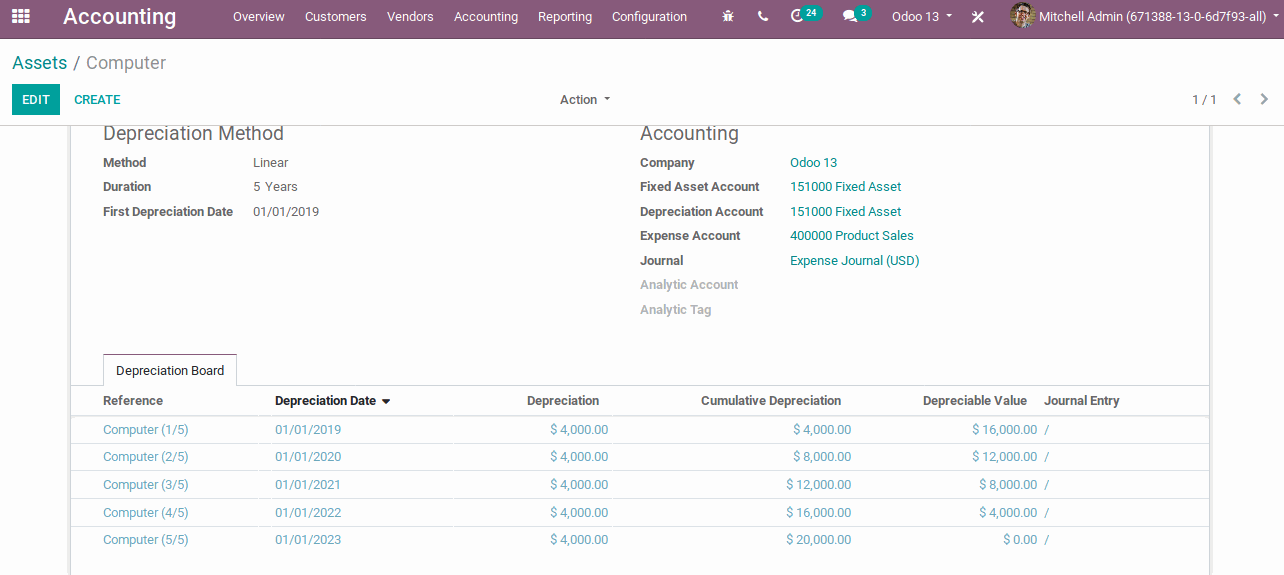

Create Asset

Accounting ➤ Accounting ➤ Assets

Accounting ➤ Vendor ➤ Bills

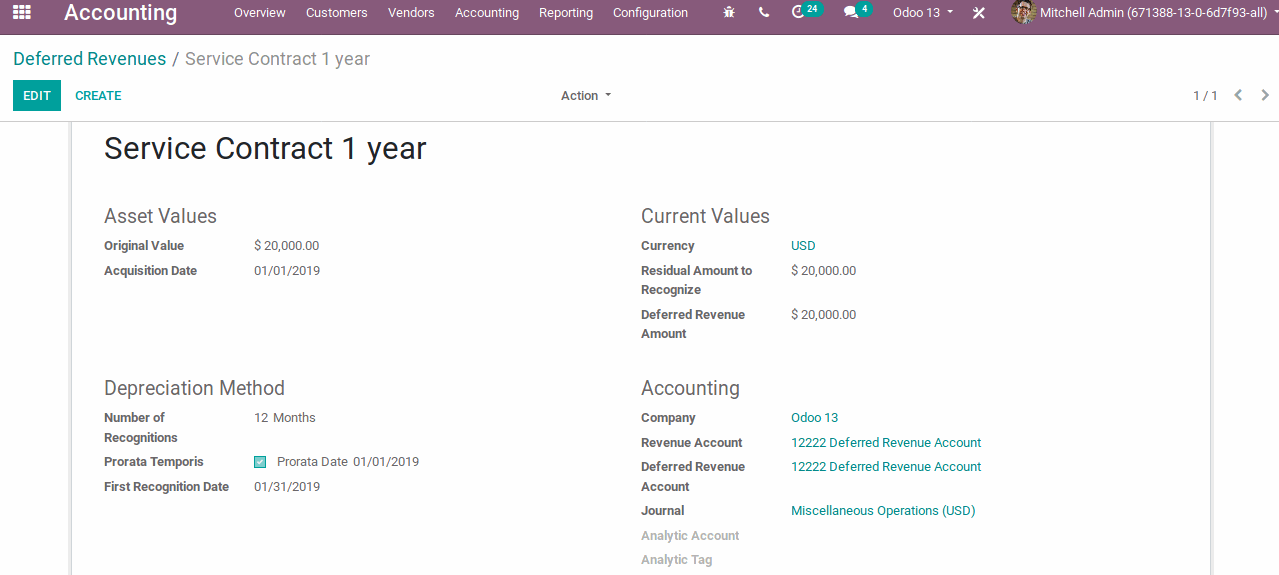

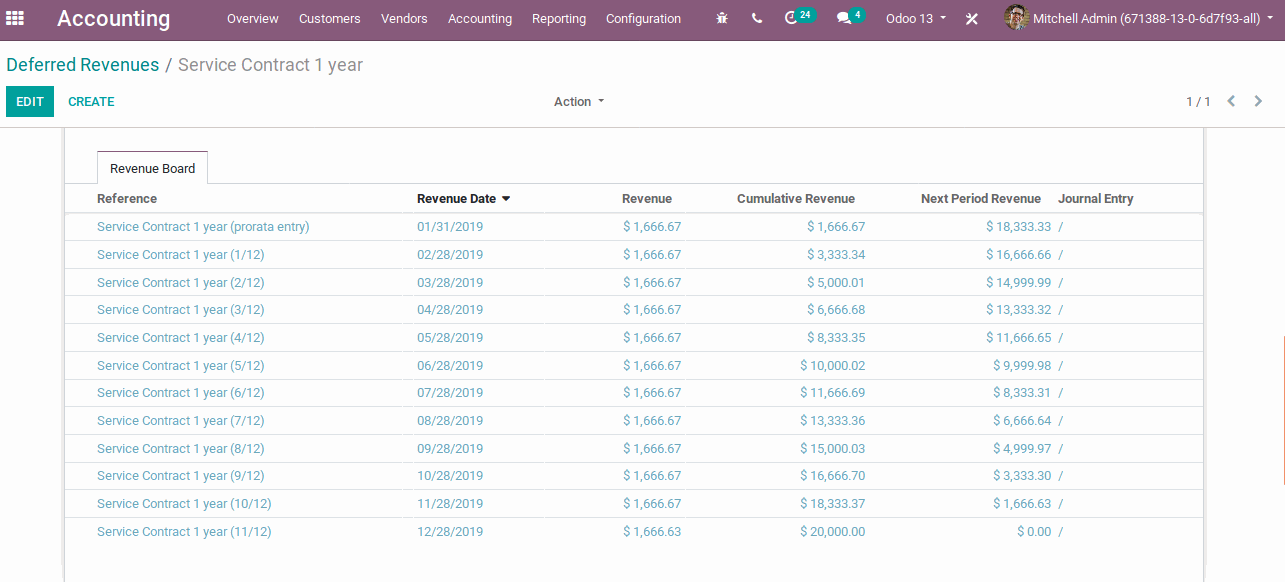

Deferred Revenue

Deferred Revenue account is a current liability account, it contains revenue that has been earned. an advance payment received by a company. It is not yet revenues so cannot be reported on the income statement.

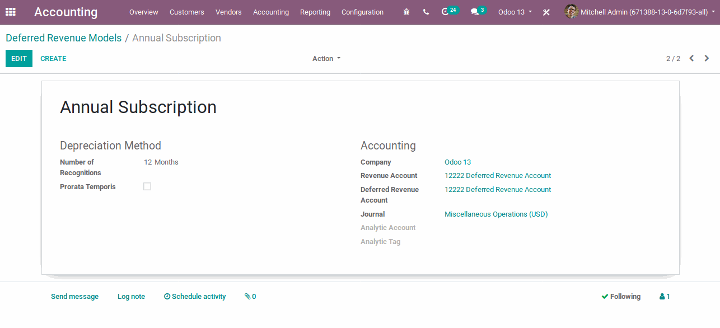

Deferred Revenue Model

Accounting ➤ Configuration ➤ Deferred Revenue Model

Deferred/unearned revenue is an advance payment recorded on the recipient's balance sheet as a liability account until either the services have been rendered or the products have been delivered.

Accounting ➤ Accounting ➤ Deferred Revenue

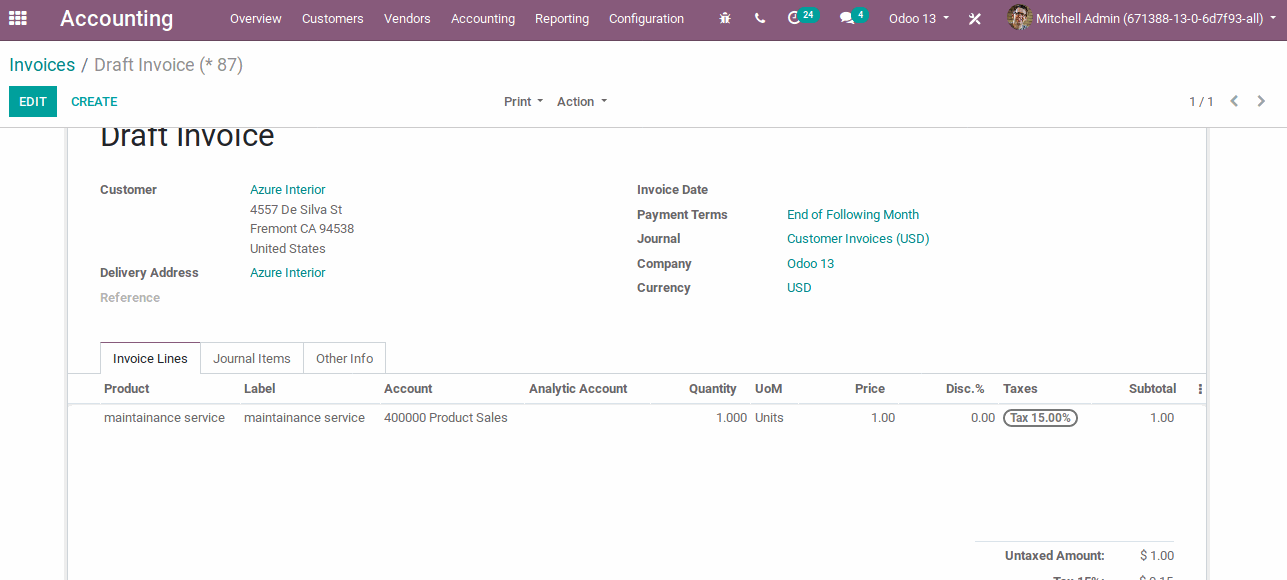

Deferred Revenue from Customer Invoice.

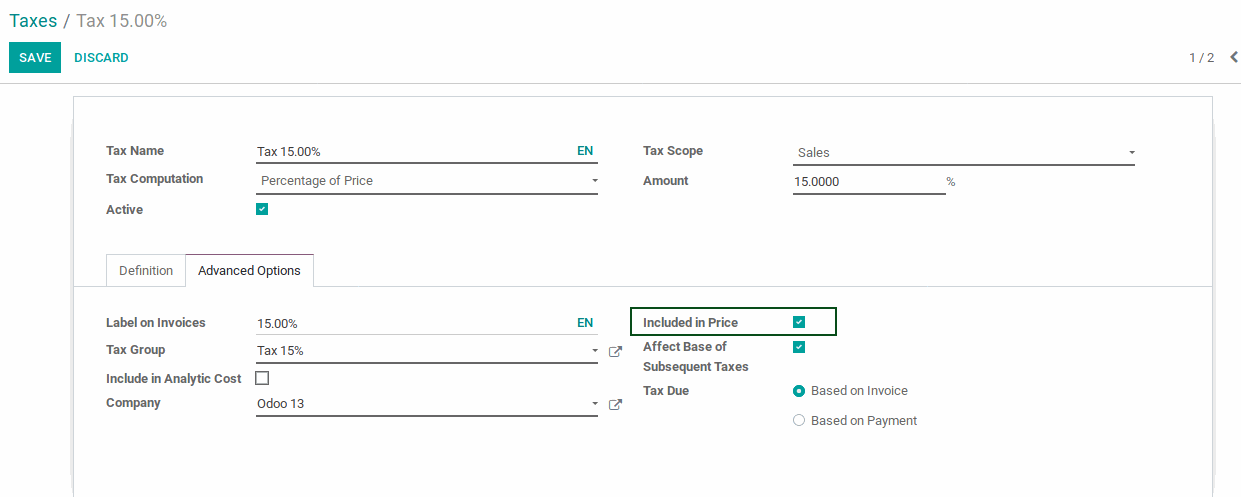

In some countries B2C prices are tax-included.

When enabling this option, the price set on the product form includes the tax. Suppose, we have a product with a sales tax of 10%. The sales price on the product form is $10.

- If the tax is not included in the price

- Price without tax: 100 $

- Taxes: 10$

- Total to pay: 110 $

- Price without tax: 100 $

- If the tax is included in the price

- Price without tax: 90.91 Taxes : 9.09 $

- Taxes : 9.09 $

- Total to pay: 100 $

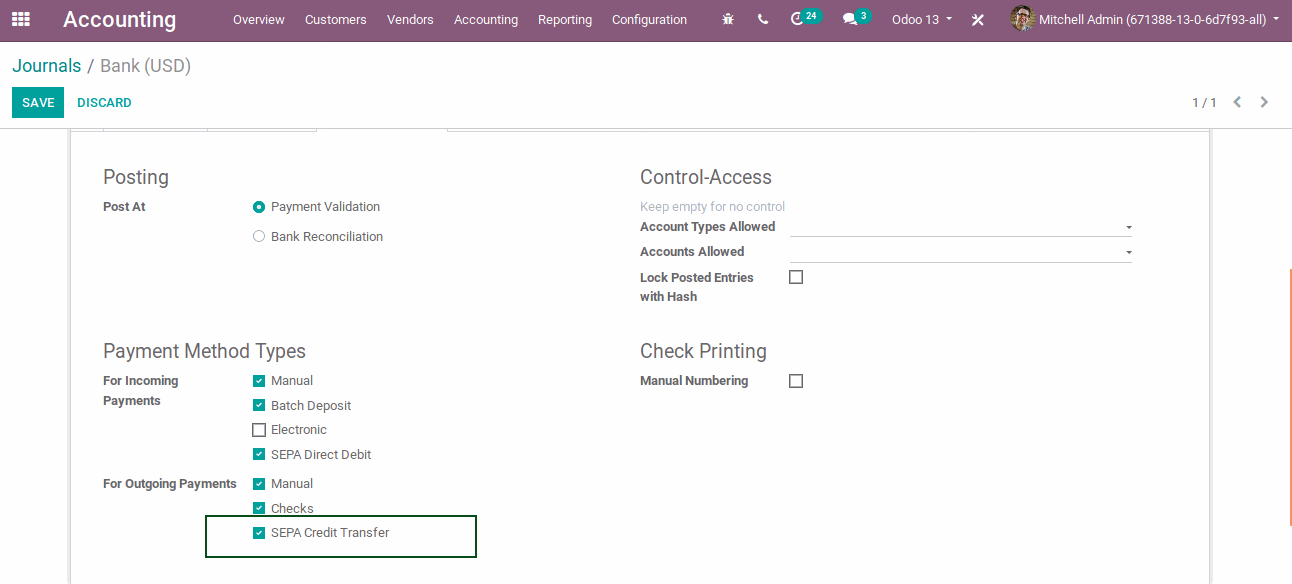

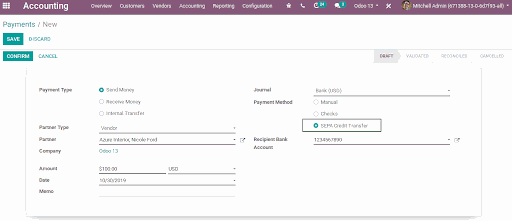

Paid with SEPA

SEPA is supported by the banks of the 28 EU member states as well as Iceland, Norway, Switzerland, Andorra, Monaco, and San Marino.

Once you decide to pay a vendor, you can select to pay the bill with SEPA. Then, at the end of the day, the manager can generate the SEPA file containing all bank wire transfers and send it to the bank. Once the payments are processed by the bank, the User can directly import the account statement inside Odoo.

Accounting ➤ Journal ➤ Bank Journal

Pay with SEPA

Accounting ➤ Vendor ➤ Payment

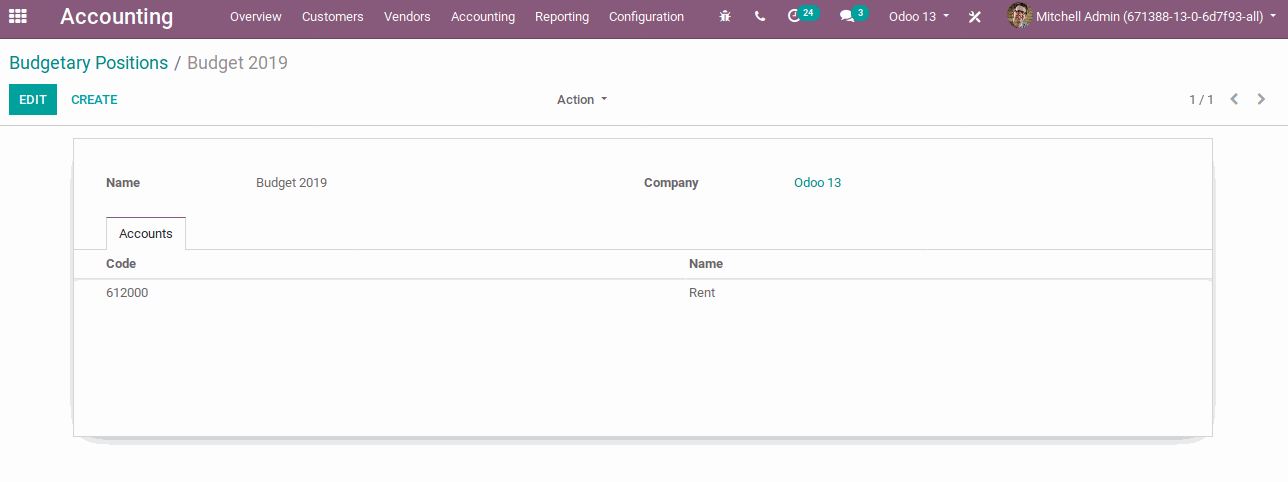

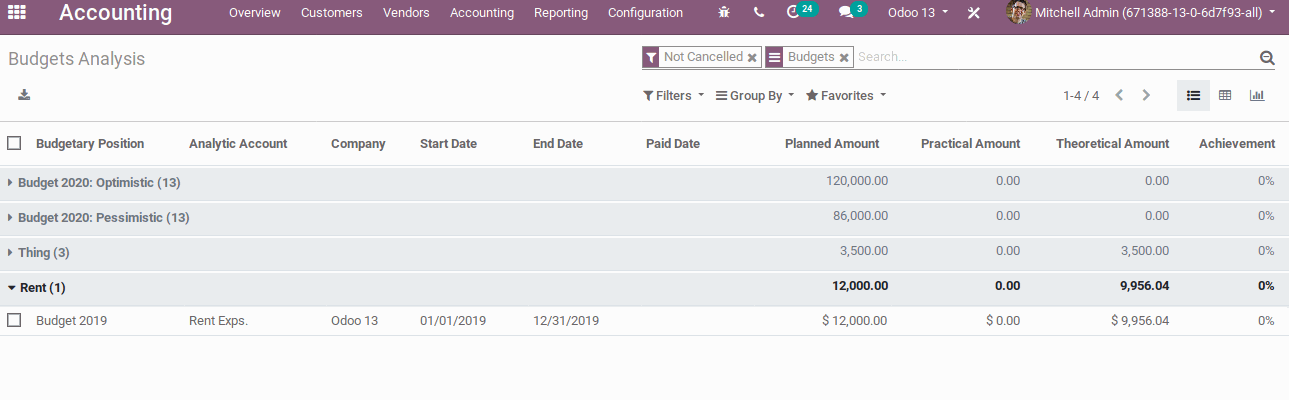

Budget

Budget Management in Odoo. Budget management is a very important thing for any business organization. The budget is used for our company by comparing the actual amount we spent and the planned expenditure.

Accounting ➤ Configuration ➤ Settings ➤ Budgetary Positions

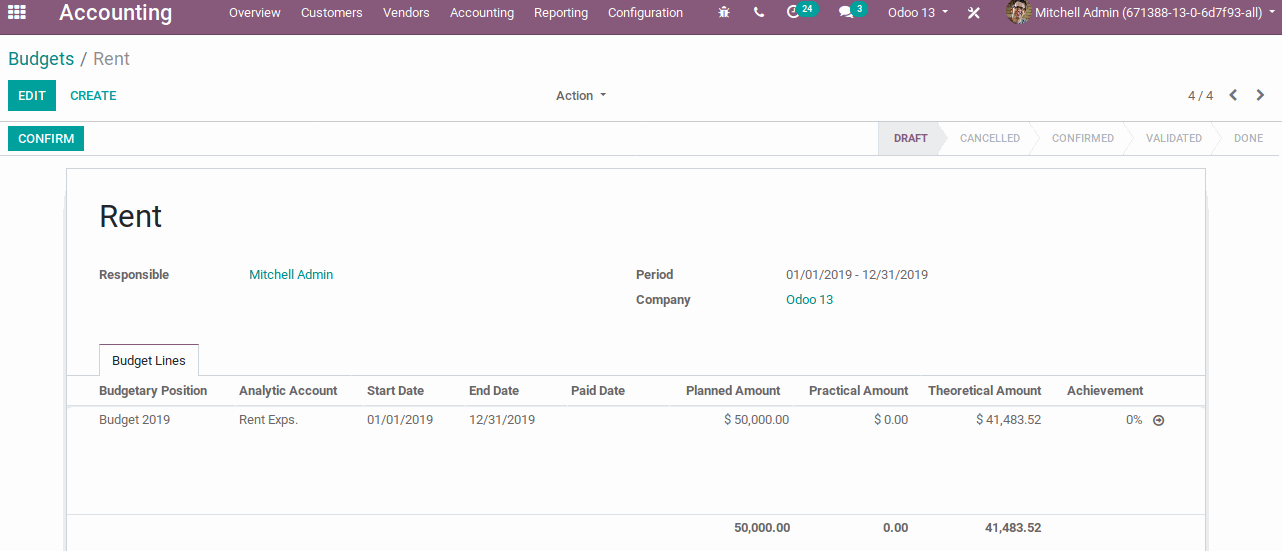

Create a Budget

Confirm and approve the budget, check the status of the budget at any time and take appropriate measures for proper budget management.

Planned Amount: The amount planned for the budget.

Practical Amount: The amount which Spends in the budget.

Theoretical Amount: It represents the money you theoretically could have spent / should have received to date. For example, your budget is 12000 for 12 months (Starting from January) and today is 31 of January, then the theoretical amount will be 1000.

Achievement: percentage of the practical amount with respect to the theoretical amount.

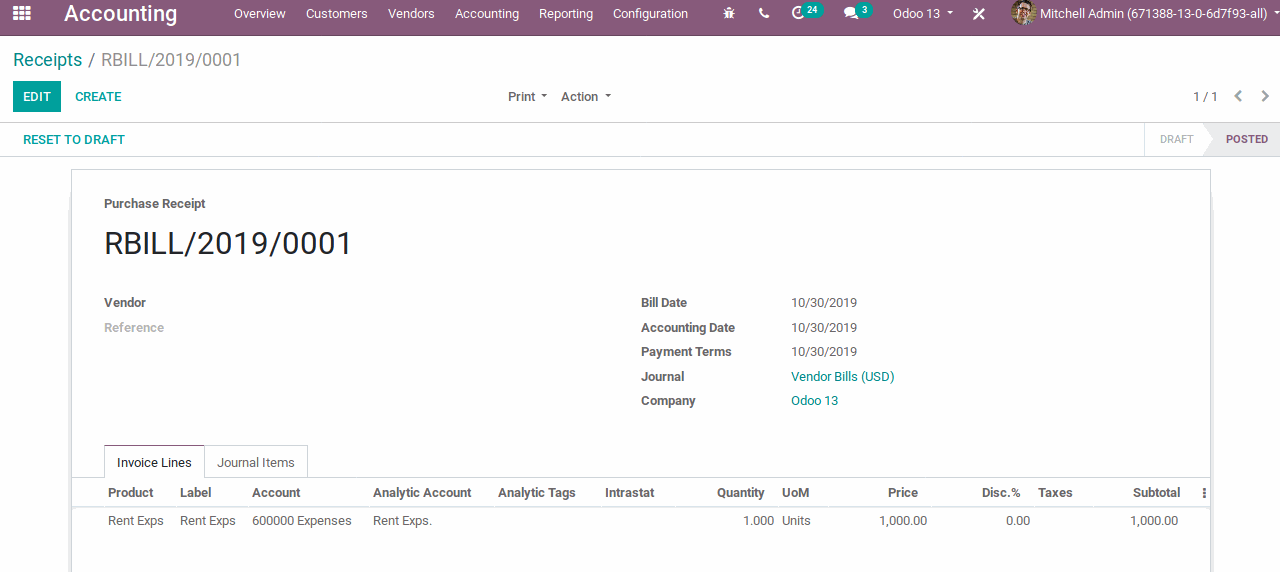

Purchase Receipt

Accounting ➤ Vendor ➤ Receipt

Budget Reports

Accounting ➤ Reporting ➤ Budget Analysis

Get more information about Odoo Accounting and accounting features from us. Caret IT is always ready to help you guys for all your issues related to Odoo.

We serve our clients with Odoo implementation, Odoo integration, Odoo Customization, and much more.

We own a team of talented Odoo experts, who are available 24x7 to guide with all your Odoo and business management issues.

Enhance your Odoo V13 Accounting drawbacks with a team that has experience and expertise in Odoo. Hire Caret It to reframe your business requirements.

Conclusion

Being an Official Silver partner of Odoo, we at Caret IT offer all the services to our clients related to Odoo. We have expertise in Odoo Implementation, Odoo modification, Odoo integration, and much more.

Connect with us for all your queries related to Odoo, our Odoo experts are always available for your assistance.