Benefits:

E-commerce is giving an opportunity to the customers to purchase products 24/7, 365 days a year and is the most effective way of selling products at a relatively low cost in the world.

When we integrate e-commerce sales channels with the Odoo ERP system, it enables us to function even more competently as a business. The key types of data, such as shipping or tracking, orders, customers, items, and inventory, are all linked to systems.

Integrated systems play a vital role in streamlining several business processes. The web sales orders are integrated into the Odoo ERP system in real-time, and this helps a back-office ERP user to track the order instantly and start with the further processing.

Information about sales appears in the Odoo ERP system promptly based on transactions.

Through integration of e-commerce with Odoo ERP business, it helps business owners to get better control of their business, thus giving them competitive gains.

Integration also helps to generate Financial reports of sales are generated by e-commerce business applications. The integration of e-commerce with ERP allows the business to generate a trial balance, balance sheet, and profit and loss statement, which provides the necessary clarity in financial information.

Conclusion

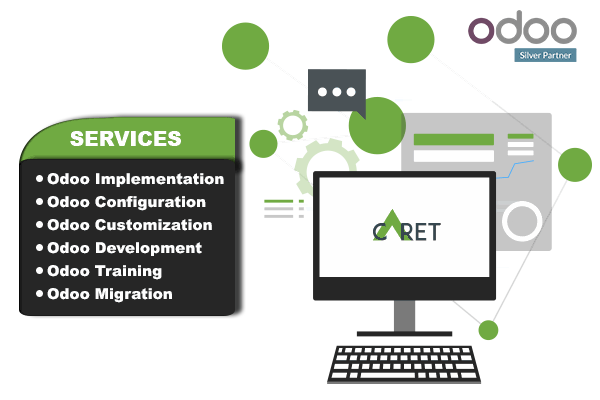

Being an Official Silver partner of Odoo, we at Caret IT offer all the services to our clients related to Odoo. We have expertise in Odoo Implementation, Odoo modification, Odoo integration, and much more.

Connect with us for all your queries related to Odoo, our Odoo experts are always available for your assistance.